Italian Tax Code: The Key to a Wide Range of Activities and Interactions

Having an Italian tax code (codice fiscale) plays a crucial role in a wide range of activities and interactions in Italy. Here are a few examples that underscore the significance of possessing an Italian tax code.

Property Transactions: A tax code is necessary when buying or inheriting a property in Italy. It is essential for signing property tenancy contracts, completing property purchases, and fulfilling associated tax obligations.

Banking and Financial Services: To open a bank account in Italy, apply for a mortgage, or conduct financial transactions, individuals must provide a tax code. Banks and financial institutions require it as part of their due diligence process.

Utility Contracts: When setting up utilities such as electricity, water, gas, or telephone services in Italy, individuals require their tax code. This ensures accurate identification and billing for these services.

Employment and Social Security: For individuals planning to work in Italy, their employers need their tax code to handle tax deductions and social security contributions. It is therefore an essential requirement for employment-related paperwork and processes.

Legal and Administrative Procedures: Various legal and administrative procedures, including obtaining a residence permit, registering a business, or dealing with government offices, necessitate a tax code. It ensures proper identification and compliance with Italian regulations.

Education and Academic Institutions: Enrolling in Italian educational institutions, such as universities or schools, often demands a tax code. It facilitates student identification, administrative processes, and the issuance of relevant documents.

General Identification Purposes: In many cases, having an Italian tax code serves as a means of identification. It establishes an individual’s unique presence in the Italian system, facilitating various transactions and interactions.

What is an Italian tax code?

The Italian tax code is a unique alphanumeric 16-digit code that serves as identification for individuals dealing with Italian authorities. Italians receive a tax code at birth, while non-Italians can request it.

Understanding the Italian tax code

The tax code consists of the individual’s family name, given name(s), date of birth, and place of birth. The tax code derives the first six figures from consonants in the name. It represents the date of birth using the year, month, and day, with an extra digit for females. A unique code for Italian towns or a sequence starting with “Z” represents the place of birth. The last letter serves as a control value generated by the system.

Your Italian tax code should exactly match your name as it appears in your passport

For example, if your name is Marie Louise Taylor, but your name appears as Marie L Taylor in your passport: your application and your tax code card should match your passport information exactly, i.e., Marie L Taylor.

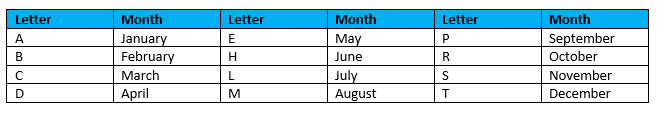

Date of birth: The date of birth is shown starting with the year (43 in the above example), month (H), day (21). The two birth date digits (from 01 to 31) are used for males; if the person is female, 40 is added to the birth date digits (21 – as in our example above, becomes 61).

Each month has a letter code:

Place of birth: the sequence regarding the place of birth indicates where an individual was born, which can be an Italian town (all Italian towns have their own unique code), or a foreign country. Usually, a foreign country is identified by a sequence starting with “Z”. In other words, if you are from the UK, no matter whether you were born in Lands End or John O’Groats, the sequence will be the same Z114 (which identifies the UK). Equally, there is a common code for the USA (all 52 states): the sequence is Z404 whether you were born in Portland Oregon or Miami FL!

The last letter is a control value, generated by the system based on specific criteria.

Where and how to apply for the tax code in Italy

To apply for a tax code in Italy, you can visit any local Tax Office (Agenzia delle Entrate). If you are abroad, you can file the application through an Italian Consulate. The Italian authorities provide the application form, and you can apply in person or appoint someone to do it on your behalf through a simple proxy.

Required documents and information for the application

The only document you need to provide for the tax code application is a valid ID, such as a passport. There is no requirement for notarizing your signature using a Notary Public. If applying from abroad without a passport, you can use another valid ID that includes your name, family name, date and place of birth, picture, and signature.

Common mistakes when applying for the Italian tax code

- Wrong date of birth format: Some applicants mistakenly use the month/day/year format, which is common in the USA. This results in an incorrect tax code that does not match the date of birth information, causing issues when dealing with official documents.

- Wrong name: It is essential that the name on the tax code matches your ID, such as your passport, even if you are known by a different name.

- Maiden names: This is a common error, particularly for females. The tax code should reflect the name as shown on the ID, usually a passport. Non-Italian females who change their family name after marriage or civil partnership should update their passports accordingly.

Conclusion

When it comes to obtaining an Italian tax code, the process may initially appear straightforward. However, it is crucial to be aware of the hidden pitfalls that can potentially lead to issues down the line. By understanding the significance of a tax code, deciphering its figures, knowing where and how to apply, and proactively avoiding common mistakes, you can ensure a seamless and trouble-free application process.

I invite you to share your own experiences of obtaining and using an Italian tax code. If you have encountered any errors in the code that led to problems, your insights can provide valuable lessons and cautionary tales for others. Together, we can learn from each other’s experiences and ensure a smoother process for future applicants.

0 Comments