Representation is the right of a descendant to replace an ascendant if the latter is unable or unwilling to accept an inheritance or legacy.

In order to take place, it must be based on two premises:

-The ascendant, who does not wish to or is unable to succeed, must legally be entitled to succeed;

-In case of testamentary succession, there must be no other provisions made by the testator which prevail over representation.

When does representation take place?

Representation thus takes places whenever someone, who is entitled to succeed a beneficiary as per Italian law or as provided for in a Will, is unable or unwilling to succeed:

-Unwilling, means the beneficiary does not accept the inheritance or renounces it;

-Unable, means that the beneficiary dies before opening the succession process, the beneficiary is unfit to inherit or has lost the right to accept.

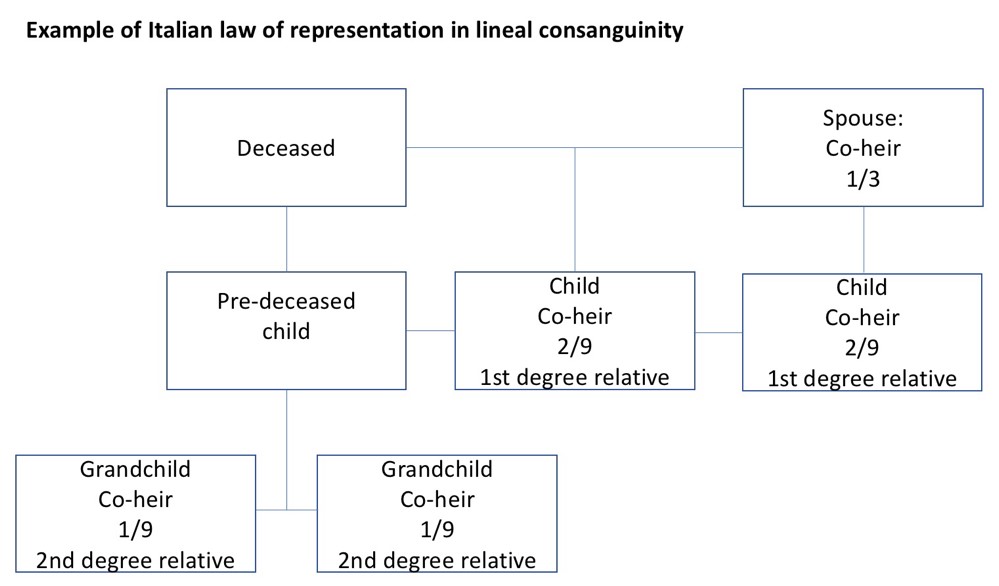

Through representation, legitimate or natural descendants replace the beneficiary unwilling or unable to succeed. If, for example, a child dies before his/her father, the father’s other children, and the predeceased child’s children will be entitled to inherit the deceased child’s part of the inheritance. These heirs will be assigned the quota which their ascendant would have been entitled to.

Representation takes place:

-In a direct line, known as lineal consanguinity, if legitimate, legitimised, adopted or natural children become co-heirs;

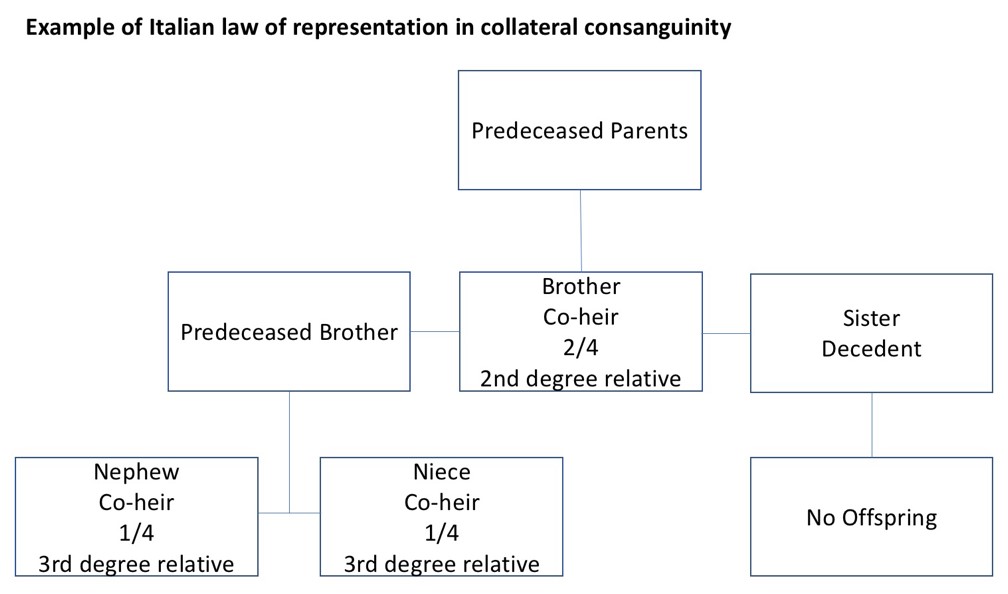

-In collateral relationships, known as collateral consanguinity, descendants of the deceased’s brothers and sisters become co-heirs.

When does not representation take place?

Representation does not apply if the person to be replaced in succession is not a descendant. For example, a sister of the deceased can make a representation but not her husband. Likewise, representation cannot occur if, in testamentary succession, the testator has already indicated in a Will what should happen in the case an entitled beneficiary is unwilling or unable to accept inheritance.

For more information about Italian succession, you might find our Guide helpful. If you would like to discuss a case with us, please contact us.

0 Comments